By: Evgeniya Vi.

18 OCT 2018

4415

The vast majority of start-ups fail within the first year. This often occurs even with a flawless business plan and an early profit. A project that is successful on paper often fails in real life. As a result, all the invested money is lost. Moreover, a novice entrepreneur will be lucky to remain debt-free.

Therefore, all new business owners worry about these issues: “Can I start without any investors?” and “Where can I get money for a start-up if it’s impossible to do it without financing?”

It is difficult to find financing for beginning entrepreneurs. After all, they are often young people who are burning with an idea but do not have sufficient income to start a business. This problem can be solved. Let’s look at the main sources that are likely to contribute money to a start-up.

Self-investment in mobile start-up financing

Someone with their own money would hardly need to look for information about possible sources of financing. This seems obvious. The most obvious things, however, are not always correct. Successful business owners, as a rule, do not earn on their investments. Nevertheless, when it is a question of a start-up, for a beginning Internet business owner, investing their own funds is one of the fastest and most effective ways to begin.

But in this case, this is the riskiest option since you yourself bear the risks, and if the start-up does not become successful, it is you who will lose your money. Always invest only an amount that you can stand to lose.

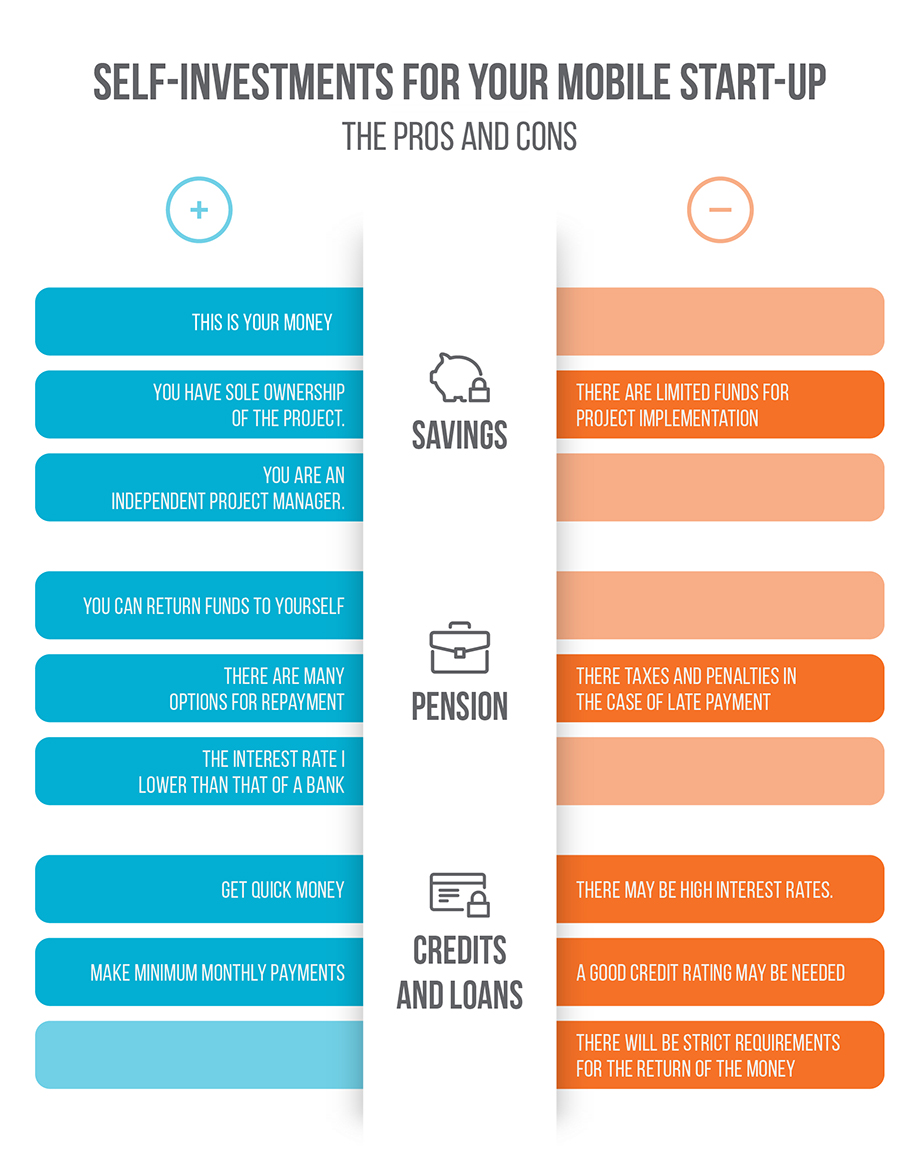

Savings

If you have your own savings that you are willing to risk, then it’s best to start with this. If your project does not become profitable, then you do not owe anything to anyone, and if it becomes successful, you will be the sole owner of your product.

Pension

Your retirement savings (401(k)) are essentially your savings, but do not rush to invest these funds in your business. You can borrow them, and this is a loan taken from yourself. Advantageous rates for such loans are low, the requirements for the borrower are minimal, and the repayment options are flexible. However, as in any type of lending, if you are late in making repayments, you will be fined and taxed. Therefore, in order not to jeopardize your retirement fund, carefully take into account all of the risks.

Credits and loans

The fastest way to get money is through credit cards. There is nothing easier. But if you miss even one minimum payment, you can easily find yourself in a hole of debt. Bank loans in this respect are more reliable, and interest on them is much lower, but to get such a loan, you will have to jump through some hoops, especially if your credit rating is low or if you have insufficient assets.

Investors: where to find for your mobile start-up

Investors can include both companies and individuals. Any of these will first need to be convinced of the future profitability of the start-up; after all, they put up their money with the expectation of a further increase in the profits of this project.

In order to interest investors, having an idea is not enough. It should be framed in an attractive shell. A business plan is an indispensable tool for attracting investors, but it is not the most effective. You will find more investors will be interested if you begin your start-up with a minimum viable product (MVP). This strategy is the most profitable.

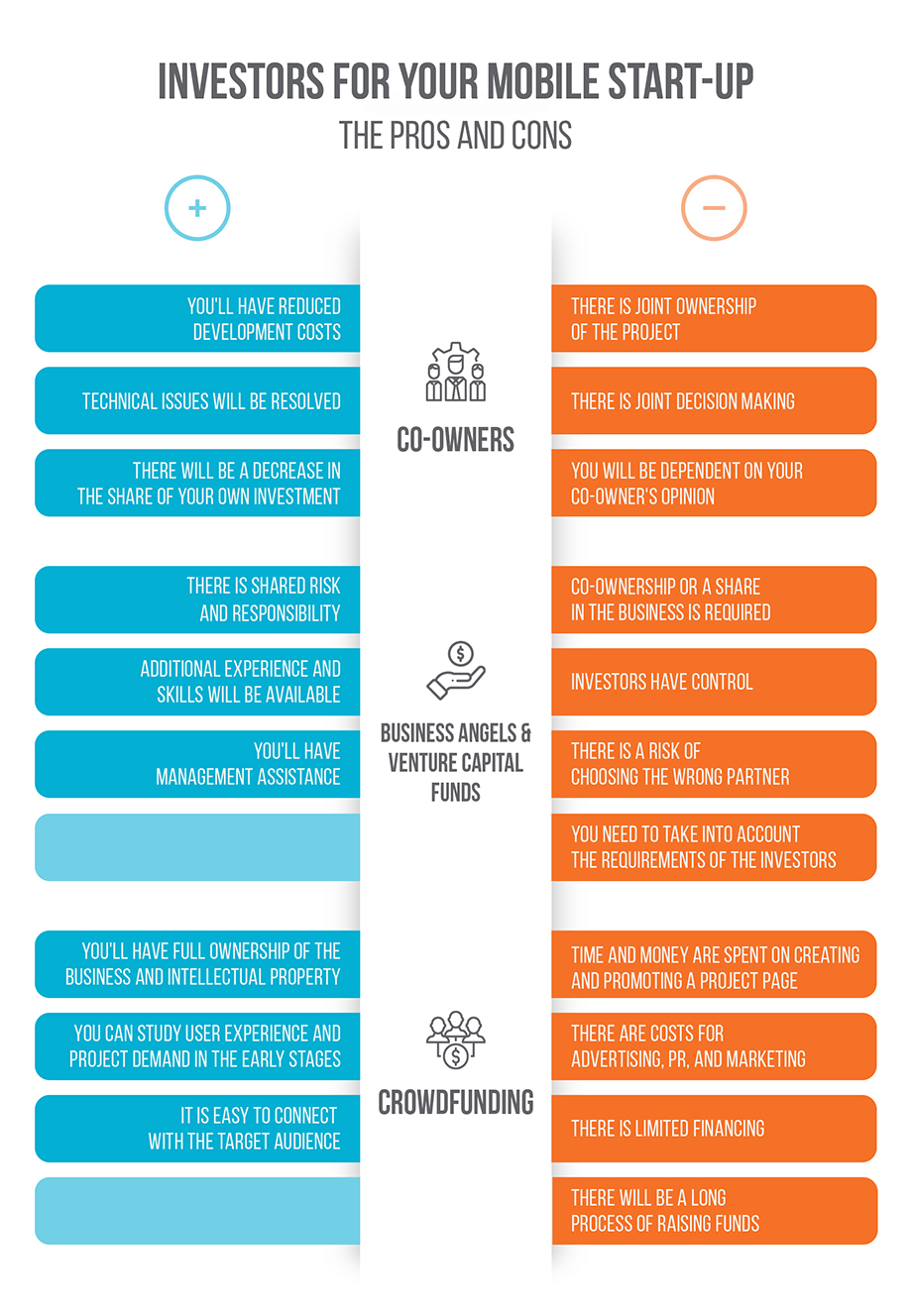

Co-owners

More than half the budget at the start of the project is undoubtedly allocated to its creation. In order to get the project started, you need to develop it, and if you do not have the necessary technical skills, you will have to turn to specialists; this is not cheap. More precisely, the price–quality principle is in effect here. If you plan to produce a high-quality product, not an amateur creation, you will need to pay for it.

Best websites to find a Co-owners for your sturt-up:

- CoFoundersLab

- CollabFinder

- Founder2be

- Hachi

- Meetup.com

- Younoodle

- Ideaswatch

- Code Army

- Founders Nation

The output can be the attraction of a partner with technical skills, naturally for a certain share in the project. For example, an application development company can become just such a partner.

Business angels

Business angels are private investors who have available funds to invest and who invest their money in start-ups in exchange for a share in the project. Business angels are accredited, their net asset value is more than $1 million or annual income for the last two years is not less than $200,000 with a similar forecast, or the total income of the family is not lower than $300,000.

Business angels willingly invest in start-ups at an early stage. Finding a business angel is easy enough, but it’s difficult to find a professional in this field. Novice investors do not yet have clear rules of interaction, and you may face a negative reaction in the event of a start-up failure.

The most popular site for finding private investors is AngelList. Special platforms are very convenient for searches, but they’re not the only resource. You can also find business angels among your friends or relatives, in social networks, or with the help of business consultants.

Business angels can invest in a project independently or on behalf of an organization. There is a practice of merging such investors into syndicates or funds, which are headed by an authoritative investor who receives a certain share of the remuneration. In each of such organizations, there cannot be more than 99 business angels.

In any case, whether it is a private investor or a syndicate member, you should look carefully at your future partner. At a minimum, scrutinize the terms of the investment, and avoid potential investors who want more than a 50% share in the business.

Places to start include:

- startups.co

- Angel Capital Association

- Gust

- Canadian Investment Network

- The BC Angel Forum

- Angel Investment Network

Venture capital funds

A venture fund is a kind of investment fund. This is an organization where it’s relatively easy to get money for a start-up. After all, they were initially created to work with high-risk or medium-risk start-up projects.

The venture fund invests money in a start-up at the creation stage in exchange for shares of the new company. This is done with the expectation of a very high profit.

More than half of start-ups fail, but these funds continue to operate since a small percentage of successful businesses can generate profits that cover all losses.

Crowdfunding

This method is becoming more and more popular every year, and it provides an opportunity to raise money from Internet users. To do this, simply register on a crowdfunding site, specify the required amount, and present your idea. The more information, photos, and videos that are posted, the more likely that users of the network will find the idea interesting and contribute their money to the project.

To attract as many people as possible, you will have to advertise, and there are no guarantees. Chances are great that it will not be possible to collect the needed amount.

Platforms such as Kickstarter and Indiegogo not only provide an opportunity to collect the necessary amount, but they also are an indicator of the success of the product: If people support your idea, it is obviously interesting to the consumer.

Crowdfunding is a long process that is not always successful. It has a number of advantages and disadvantages. With this means of attracting money, you remain the owner of your product. At the same time, you should already have a specific project, not just a business plan, as in the case of other types of investments.

In addition, crowdfunding platforms are allowed to sell projects even in the fundraising phase, for example, Indiegogo/InDemand and MoMA.

The most significant disadvantage is that this method of financing is fairly new, so there are no clear trends for the long term.

Top crowdfunding platforms:

- Kickstarter

- Patreon

- Crowdcube

- Crowdrise

- RocketHub

- Razoo

- Indiegogo

- Crowdfunder

- Give

- GoFundMe

- Charitable

- Lending Club

- PledgeMusic

- Funding Circle

- Ulule

- Seed&Spark

- Kiva

- GoGetFunding

- Fundable

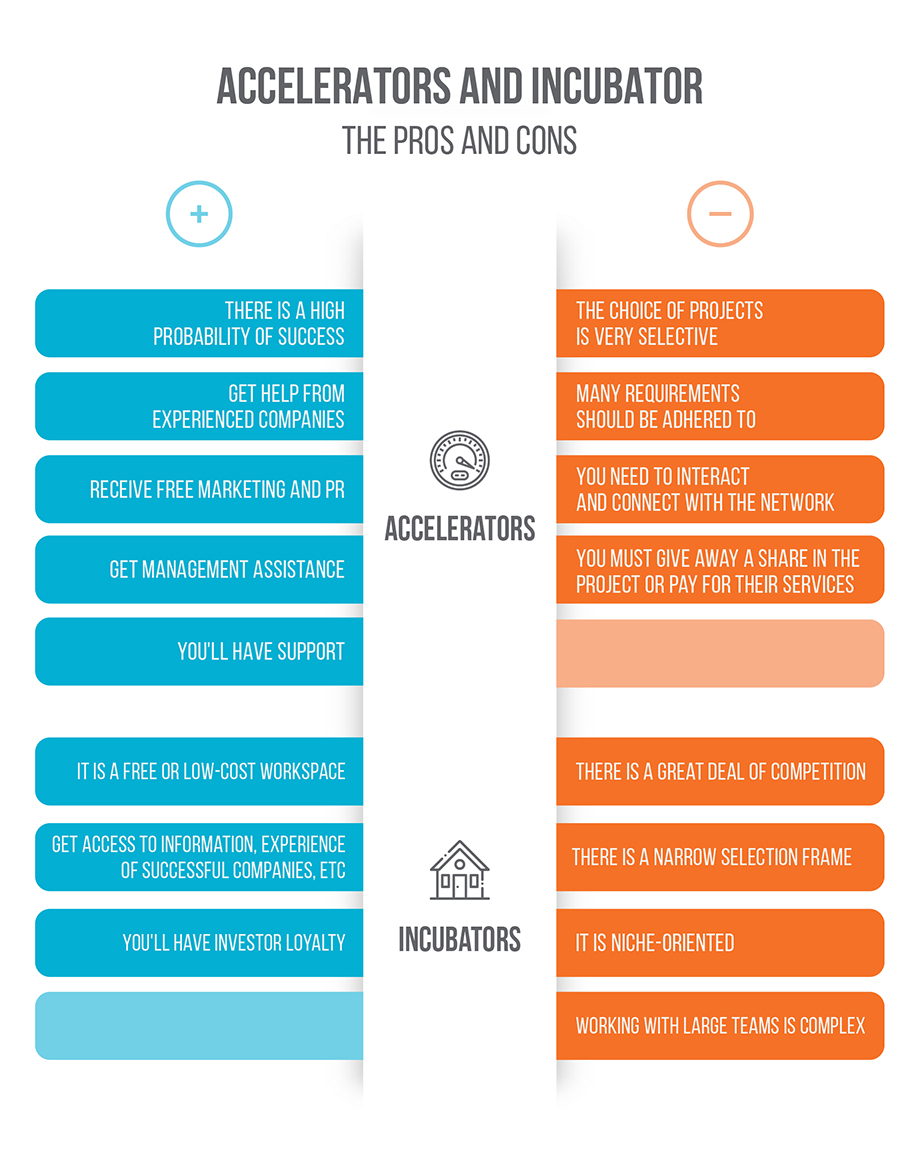

Accelerators and incubators for your mobile start-up

These are companies and platforms that help start-ups develop both strategically and financially.

An incubator is the development of an idea, while an accelerator is the growth of a start-up. Most start-ups strive at first to join the accelerator phase right away in order to attract money as quickly as possible, even if they only have an idea at the moment.

Accelerators very rarely pay attention to start-ups with only one founder—that is, if there is no “partner” and, even worse, if there is no team. Investors also, as a rule, need proof of traction. Therefore, consider developing your project in the incubator, where you will receive help and support to determine the right path for your future company. After this, you will be able to choose the right accelerator.

Incubators

These structures help projects in the early stages to develop their idea, identify the target audience, build a team, get their first clients, and then receive feedback from these initial clients. In other words, the incubator helps a start-up to create a solid foundation on which they can further develop and grow.

There are currently a lot of different start-up incubators, and they all work on different business models; some can, for example, “invest” in a start-up in exchange for a share in the future company, while others make a cash payment and do not take part in the actual project. In addition, incubators focus on start-ups in the early stages of development, and they may have very different terms for “growing” projects. Some, for example, are designed for three months and some others for more than two years.

If you are currently at the idea stage or, perhaps, there is already an MVP for a start-up incubator, this is the needed structure that can seriously help the development of your project.

There are both independent incubators sponsored by VC companies and incubators that are managed by government agencies and corporations. A good example of this is Idealab.

Incubators are multifaceted. Some are focused on a certain market depending on the sponsor; for example, hospitals sponsor start-ups in health technologies.

Start-ups tend to be housed in a co-working environment, according to their geographic area, in order to co-exist with other companies and a wide-ranging community of entrepreneurs.

Large teams are most likely to feel uncomfortable in an incubator environment, and there will come a time when renting their own office will be cheaper than working in the incubator.

Accelerators

Accelerators, as a rule, are less diverse in terms of their business model. Most invest in start-ups by providing mentoring support and take a share in the project for their services rather than money. Start-ups at this stage already have a certain amount of traction, have put together a team and are ready to accept investments as well as mentors’ support to develop the traction that already exists.

These programs are usually short and intense. In other words, the accelerator helps start-ups prepare for getting “big money.” Once they determine the most effective plan for their growth and development, investments can help them continue to grow faster. Often, start-ups meet investors during their time in an acceleration program or during the “demo days,” which project founders use to attract investors.

Y Combinator, TechStars, and Brandery are some of the most well-known accelerators.

Accelerators, as a rule, choose teams that they believe in and which, in their opinion, are able to implement the idea. Being selected for a specific program is, as a rule, taken very seriously. The accelerator owners have a direct interest in the success of the project as they take not money but rather a share in the future company. Y Combinator accepts about 2% of the applications that it receives, and TechStars takes only 10 out of every 1,000 applications.

The list of the most popular incubators and accelerators:

- Y Combinator

- TechStars

- 500 Startups

- I/O Ventures

- DreamIt Ventures

- Kicklabs

- The Hatchery

- Excelerate Labs

- Capital Factory

- EnterpriseWorks

- AngelPad

- Ben Franklin TechVentures

- Entrepreneurs Roundtable Accelerator

- Tech Wildcatters

- Launchpad LA

- The Brandery

- Awesome Inc.

- Founder’s Co-op

- Seedcamp

- StartFast

Other resources

In addition to the above resources to help you find the means to implement your idea for a mobile application and the development of a start-up, there are still many other opportunities. Different countries and different industries have unique nuances. If you are looking for more resources, it’s worth exploring all the possibilities, such as:

- Government funding and subsidies. In many countries and even in different regions of the same country, there are specialized programs that are designed to support small and medium-sized entrepreneurship or entrepreneurship in a particular industry. Typically, this is financial assistance on a refundable or non-refundable basis that involves the intended use. To participate in these types of programs, it will be necessary to meet certain requirements, which will include partial financing of the project from your own funds and a clear and attractive business plan.

- Non-commercial projects will usually qualify for this type of financing, but there are exceptions for social entrepreneurship—that is, a project that solves significant societal problems. Grants are provided by state bodies, representative offices, or various funds.

- These are organizations whose missions provide financial and/or technical assistance to start-ups or small and medium-sized enterprises on a sometimes competitive basis.

- This is the charitable help of individuals on a voluntary basis. It is difficult to find patrons, but it is possible, as providing charitable assistance strengthens the patron’s image.

In conclusion

The most difficult stage is the process between the birth of an idea and its implementation. This stage is complicated in all aspects, including in the field of financing. If you have free resources that you can painlessly take advantage of, you’re one step ahead. Otherwise, you need to find the necessary resources.

The main thing that you need to understand is that the more you interest a potential investor, the faster you will get financing. It is obvious that in most cases, the idea alone is not enough, so you have to be prepared:

- Draw up a detailed and attractive business plan.

- Make a presentation of your project.

- Introduce investors to your team.

- Show that you already have clients interested in the product or service.

- Do not limit yourself to paper and figures but show the finished product or its prototype. Even better, show potential investors your MVP.

Choose the type of financing you require based on the characteristics of your project and your strengths.

Whichever type of financing you choose, make sure that the investment plan assumes income.

Good luck with your project!

Services

Services

Work

Work

Company

Company

Blog

Blog

Contact

Contact